The crucial thing to inquire of yourself when you compare remortgages are, Can i pay the cost for the complete time of this new remortgage? For folks who skip a cost, you’ll likely become charged additional appeal out-of a belated fee fee and when you’re to carry on so you’re able to default in your costs, you could potentially treat your home.

Remortgaging which have bad credit can be done however, preferably, you should talk to a large financial company that will lookup at your specific state, such as the complexity of your poor credit.

Specific lenders will consider the reason for the fresh new less than perfect credit, very explore this together with your broker to prepare having a credit card applicatoin and acquire lenders that can be much more willing to loan to you personally.

Regardless why, if you have a less than perfect credit score, what you can do locate almost any credit was restricted and if you’re provided to shop for a separate household, you will be top talking to one of the gurus, who will assist regardless of if their poor credit are most recent

It isn’t hopeless there is lenders in the uk you to undertake individuals which have CCJs, IVAs as well as somebody that has started broke. Therefore, depending on your needs, you will be entitled to remortgage so you can consolidate expense. This would cover remortgaging to possess an expense who would pay off their prior mortgage together with repay your debt.

The benefit of doing this is you have one monthly cost for your expenses as opposed to several mortgage payments to different loan providers. This may ease a few of the anxieties you to settling expense can also be offer however, like most financial contract, there are some significant factors.

Sometimes, but most certainly not all the, the speed charged for a great remortgage try lower than you to getting a charge card, personal loan otherwise auto loan agreement. Hence, moving forward your debt to just one remortgage will help get rid of the month-to-month pricing to suit your loans.

An excellent remortgage to consolidate obligations is a huge decision that will feeling your finances in the long run, therefore getting the right contract, with sensible payments things.

Credit scores – How important are they and exactly how would they work?

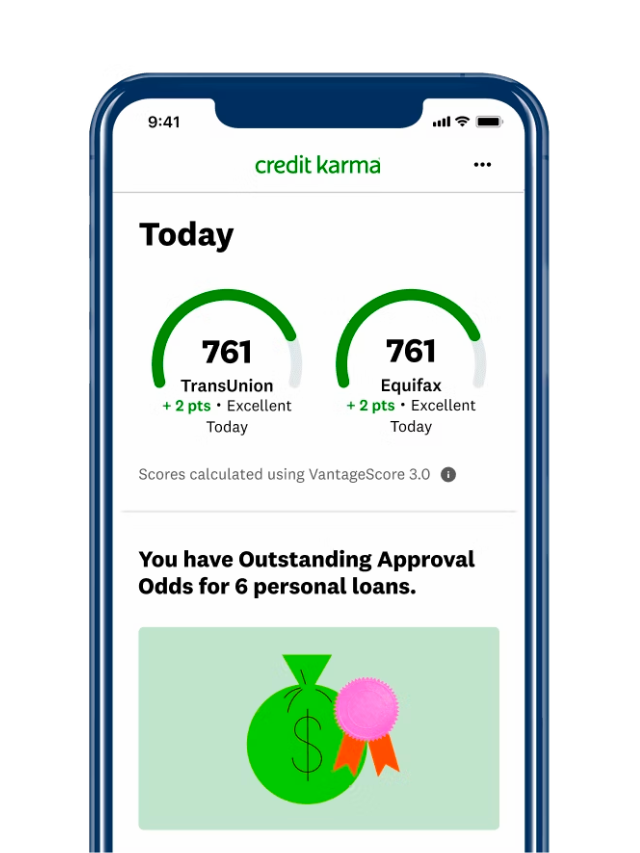

Your credit rating offers lenders an idea on what better your perform currency plus the amount of risk he is providing when they financing your currency. The low your own score, the greater the chance lenders commonly consider one to feel.

Loan providers look at the credit rating as well as your function while making payments before deciding whether or not to approve any borrowing software, as well as credit cards, funds and you may mortgage loans. Fundamentally, they use account in one of these two main credit reference businesses (Experian and you may Equifax) which calculate your credit rating and create a credit report mainly based on:

- Your level of obligations and you may readily available credit; most lenders don’t want to see you using more than fifty% of the available credit.

- Your fees history around the one borrowing plans you hold, along with whether or not you have made money punctually incase your features repaid at least the minimum matter necessary.

- Later costs will normally rise above the crowd since the an awful and will lower your credit score.

- For those who have a bankruptcy proceeding, Personal Voluntary Plan (IVA), Debt settlement Buy (DRO), otherwise Obligations Management Package (DMP) on your personal credit record, just how long this has been on there and you will if this have been discharged.

- If or not you may have any County Court Decisions (CCJs) up against your own name as well as how way back these were awarded.

- Just how many borrowing from the bank apps you made as well as over what time.

These get an elevated effect on your own rating than the others. But not, not one stay on your credit history permanently: Later repayments, IVAs, Condition Judge Decisions (CCJs) and you can payday loans Eustis case of bankruptcy was eliminated shortly after half dozen age.